The default estimate for homeowners insurance is 0.35% and can also be adjusted in the VA loan calculator's advanced settings.

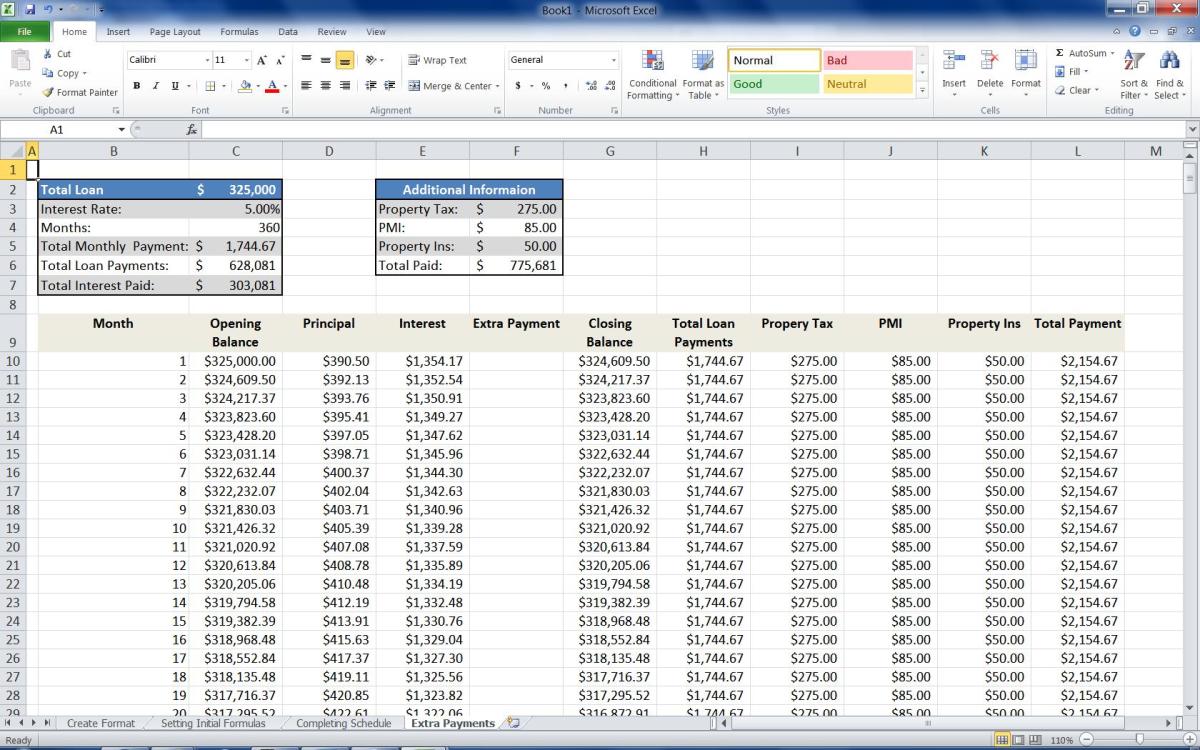

Property tax estimates default in our calculator to 1.2%, but you can edit this under the advanced setting. Those who are not disabled and previously used a VA loan will pay a higher VA funding fee than the first VA loan use. If you are VA disabled, you do not have to pay the VA funding fee. However, surviving spouses do not have to pay the VA funding fee. Regular military and Guard/Reserves members now typically pay the same VA funding fee. VA loan refinancing comes with a different VA funding fee than purchase loans, which affects your monthly payment. The VA loan offers both purchase and refinance options. You can leave this at $0 or include a down payment if you wish. The signature benefit of the VA loan is $0 money down. Below is a quick look at how each impacts your VA loan payment. VA Mortgage Calculator Adjustmentsįor the most accurate estimate, we recommend filling out all relevant fields. Your actual rate, payment and terms are subject to the policies of your lender. The VA loan rate shown is a broad estimate based on current market conditions and is for educational purposes only. We recommend filling in the remaining fields for the most accurate VA loan payment estimate. To utilize our VA loan calculator, simply plug in your VA loan amount in the "Home Value" section for an immediate calculation. Our VA loan calculator provides an accurate representation of potential monthly payments by including property taxes, homeowners insurance and the VA funding fee.

VAMortgageCenter's VA loan calculator provides Veterans, active military and surviving spouses the ability to quickly and easily estimate their monthly payments with a VA loan.

0 kommentar(er)

0 kommentar(er)